Supercharge your lead generation with a FREE Google Ads audit - no strings attached! See how you can generate more and higher quality leads

Get My Free Google Ads AuditFree consultation

No commitment

Supercharge your lead generation with a FREE LinkedIn Ads audit - no strings attached! See how you can generate more and higher quality leads

Get My Free Google Ads AuditFree consultation

No commitment

Supercharge your lead generation with a FREE Meta Ads audit - no strings attached! See how you can generate more and higher quality leads

Get My Free Google Ads AuditGet My Free LinkedIn Ads AuditGet My Free Meta Ads AuditFree consultation

No commitment

Supercharge your lead generation with a FREE Google Ads audit - no strings attached! See how you can generate more and higher quality leads

Get My Free Google Ads AuditFree consultation

No commitment

In today's complex marketing landscape, effective B2B marketing requires a strategic mix of both online and offline channels working together to drive growth. Google Ads plays a critical role for insurance services, capturing high-intent prospects exactly when they're searching for solutions. This powerful middle-funnel tool bridges the gap between broad awareness efforts and your sales process, helping intercept decision-makers at their moment of need. With potential clients often researching services without submitting a form, technology now allows you to target these high-value prospects directly, ensuring your ad spend focuses on real decision-makers with real intent rather than cold traffic. By measuring ROI from click to close and complementing other channels through remarketing strategies, businesses can make smarter budget allocations and maintain a competitive edge.

Revenue-focused insurance teams face a unique challenge: aligning intent-rich digital signals with the actual buyer journey. Capturing high-quality leads in this environment requires more than simply launching ads—it demands a data-driven approach that connects every touchpoint for real-time optimization with Sona Buyer Journeys.

This guide delivers a complete framework for leveraging Google Ads for insurance services, equipping marketers to harness precise audience targeting, dynamic creative strategies, and advanced attribution models. For a detailed look at how insurance agents can use Google Ads to generate leads and boost customer acquisition, review this insurance leads Google Ads guide. By adopting integrated campaign execution, insurance providers can rapidly convert online interest into qualified consultations and policy applications.

Effective insurance advertising strategies begin with detailed keyword research. Instead of relying on broad, generic terms, marketers should develop segmented lists that capture specific service lines, such as “small business liability insurance” or “affordable health coverage for families.” To learn more about effective keyword research and campaign setup, visit this step-by-step Google Ads tutorial. Advanced solutions can identify not just which terms drive clicks, but which lead to conversions and policy sales, guiding continuous keyword refinement.

Google Ads targeting for insurance benefits from integrating both demographic and behavioral data. Marketers can create granular segments—such as age, occupation, or life stage—while layering in web activity and in-market signals. By leveraging precise audience intelligence, audience lists stay current, meaning ads are only delivered to prospects demonstrating genuine purchase intent.

Landing page alignment is critical for insurance lead generation. Pages must mirror ad messaging, address regulatory requirements, and remove friction from the quote or consultation process. Incorporating real-time visitor identification enables dynamic personalization, allowing landing experiences to adapt based on company, location, or policy needs.

Once campaigns are live, ongoing optimization is key. Marketers should monitor performance across campaigns, ad groups, and creatives, using advanced conversion tracking to link online interactions with offline sales outcomes. For more on integrating ad platform cost data with analytics for full-funnel visibility, see this Google Analytics integration guide.

Insurance agency online advertising thrives on agility. Campaigns must evolve as buyer intent shifts, with audience and creative elements updating in real time. Automated workflows can push enriched leads, updated audience segments, and conversion events to both Google Ads and sales platforms. This feedback loop ensures marketing and sales teams act on the freshest insights, accelerating pipeline velocity and boosting ROI. Ready to put these strategies into action? Get started for free with Sona.

Insurance services face persistent challenges in reaching qualified buyers at the exact moment when coverage decisions are made. Google Ads solves this by intercepting high-intent prospects, delivering policy offers as individuals and business decision-makers research quotes, compare options, and evaluate providers. This real-time presence elevates insurance agency online advertising by matching ad delivery with searcher urgency, ensuring every impression targets users ready to convert.

Intent-based segmentation in Google Ads for Insurance Services further accelerates pipeline velocity. By layering geographic, demographic, and behavioral signals, insurance marketers can refine targeting to focus on lucrative regions, underserved demographics, or emerging risks. Advanced platforms allow marketers to move beyond anonymous web visits, pinpointing both individuals and organizations researching coverage. This level of transparency supports precise budget shifts, focusing spend on accounts most likely to convert and maximizing the impact of every campaign with Sona Identification.

Insurance advertising strategies benefit from the integration of real-time data and audience enrichment. As leads progress through the evaluation process, dynamic audience updates ensure that messaging evolves alongside prospect behavior. This approach not only improves PPC for insurance agents but also enhances conversion tracking by attributing both online and offline sales activity, painting a complete picture of ROI. With enriched CRM and ad platform sync, insurance agencies streamline their digital marketing for insurance, unifying marketing and sales data to drive more effective, compliant, and measurable campaigns.

Insurance agencies leverage several Google Ads campaign types to move prospects efficiently through the buying journey and create sustainable pipelines. Each campaign format is designed to address distinct intent signals, maximize qualified lead volume, and strengthen brand credibility in a highly regulated, competitive vertical. Combining these formats delivers complete funnel coverage, from initial awareness to conversion-ready actions.

To see how these campaign types work together and explore actionable strategies for your agency, get started for free with Sona.

Insurance providers seeking to scale must look beyond saturated marketing channels and explore new avenues uniquely aligned with their specialized offerings. By identifying vertical keywords specific to niche insurance products—such as cyber liability, disability, or commercial trucking insurance—agencies can capture intent-driven traffic that is both underserved and highly valuable. For additional insight, this guide to generating insurance leads with Google Ads highlights why targeted search strategies are so effective for boosting customer acquisition.

Competitor gap analysis reveals untapped segments where rivals have limited presence or weak content. This process spotlights opportunities to create targeted campaigns around underserved needs, driving visibility in competitive markets. Marketers leveraging advanced analytics platforms can identify which competitors dominate core keywords and which segments remain unaddressed, then concentrate resources on filling those strategic voids.

Industry directories and authoritative insurance marketplaces remain overlooked channels for insurance advertising strategies. By placing content and offers where decision-makers search for trusted providers, agencies increase referral traffic and bolster their credibility. Educational assets—whitepapers, explainer videos, and in-depth guides—serve as high-value touchpoints for insurance lead generation, especially when paired with ad retargeting campaigns. These assets allow marketers to nurture prospects over time, building trust and guiding buyers closer to conversion.

Predictive models now empower insurance teams to prioritize outreach toward accounts exhibiting high purchase intent. Real-time behavioral signals—such as website visits to policy comparison pages or repeated engagement with pricing calculators—reveal readiness to buy. Integrating these signals with campaign execution allows marketers to dynamically shift budget and messaging to in-market leads, ensuring resources are focused on high-likelihood conversions. Platforms capable of unifying visitor identification and intent data provide a decisive edge, enabling B2B revenue teams to personalize engagement, sync enriched audiences directly into Google Ads, and optimize insurance services online visibility at scale. To see how this works in practice, get started for free with Sona.

Audience segmentation for insurance services empowers marketers to align their outreach with the distinct needs and behaviors of every customer profile. Effective segmentation not only sharpens targeting but also drives higher conversion rates, as campaigns are crafted around granular insights into policyholder intent and lifecycle stage.

Audience segmentation in insurance digital marketing is not simply a tactical exercise; it is a foundational strategy that unlocks more meaningful engagement, streamlined lead generation, and measurable growth across every phase of the customer journey. To take your segmentation and targeting to the next level, get started for free with Sona.

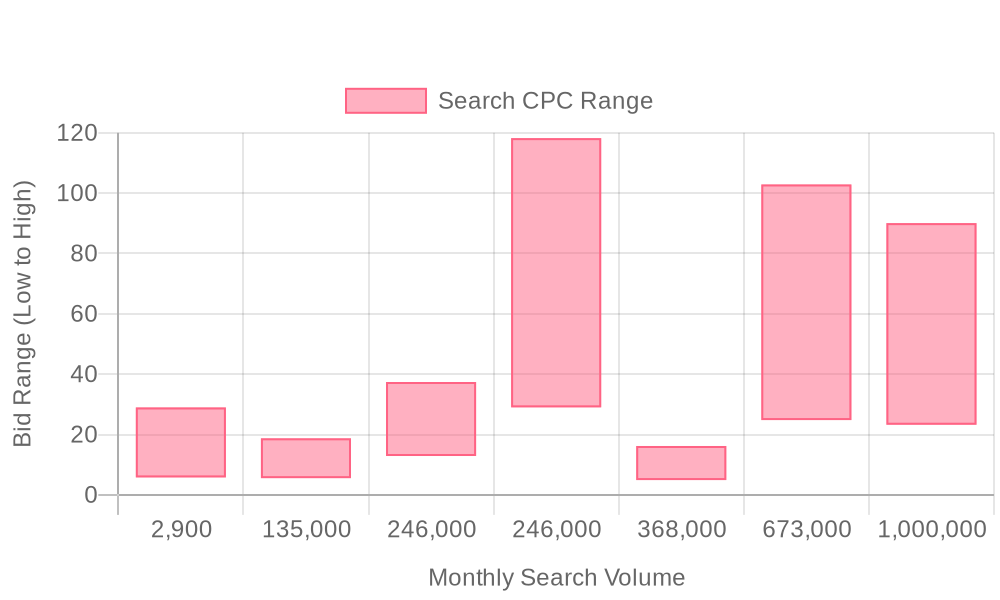

| Industry | Keyword | Monthly Search Volume | Competition Level | Low Bid | High Bid |

| Insurance Services | insurance services | 2900 | LOW | 5.79 | 28.98 |

| Insurance Services | travel insurance | 135000 | MEDIUM | 5.55 | 18.75 |

| Insurance Services | life insurance | 246000 | MEDIUM | 12.88 | 37.41 |

| Insurance Services | auto insurance quote | 246000 | MEDIUM | 29.01 | 118.24 |

| Insurance Services | health insurance | 368000 | MEDIUM | 4.91 | 16.21 |

| Insurance Services | auto insurance | 673000 | MEDIUM | 24.79 | 102.87 |

| Insurance Services | car insurance | 1000000 | MEDIUM | 23.24 | 90.07 |

Insurance services operate in a fiercely competitive digital landscape, where the right keyword strategy determines both the volume and quality of inbound leads. High-intent prospects routinely turn to search engines for solutions, making keyword targeting the central force behind effective insurance lead generation and ROI-driven online advertising. For additional insights on the effectiveness of Google Ads for insurance agents, explore this analysis of Google Ads for insurance agents.

A robust Google Ads strategy for insurance services begins with mapping the full spectrum of relevant keywords across product lines, customer segments, and purchase intent. For broad reach, terms like "auto insurance quotes," "small business insurance," or "affordable health coverage" capture high search volumes and drive top-of-funnel activity. However, these generic terms often attract costly, less-qualified clicks due to intense competition. To counterbalance, insurance marketers prioritize long-tail variations such as "best cyber liability insurance for tech startups" or "family dental insurance with no waiting period," which convert at higher rates and reduce cost-per-lead. This dual-track approach ensures campaigns reach both mass-market and niche prospects while protecting budget efficiency.

Predictive scoring and behavioral intelligence elevate keyword targeting from tactical to strategic. By analyzing historical conversion data, marketers can identify when a specific search term is most likely to generate valuable engagement, prompting more aggressive bidding at peak times. Real-time audience and intent data further refine spend allocation, allowing teams to shift budget toward in-market accounts as soon as buying signals appear. When CRM and ad platforms are unified, enriched lead and company attributes can be synced directly into Google Ads—dynamically updating audience lists and enabling hyper-targeted messaging as prospects move through the funnel. This closed-loop approach makes it possible to attribute conversions to specific keyword themes, optimize future campaigns based on full-funnel ROI, and continually improve the effectiveness of insurance advertising strategies.

Sample target terms for Google Ads insurance marketing campaigns include:

By leveraging advanced data enrichment and real-time audience insights, insurance agencies can ensure their Google Ads targeting for insurance is always one step ahead of market shifts. This data-driven approach maximizes efficiency, drives qualified traffic, and accelerates insurance agency online advertising success. Ready to transform your insurance advertising strategy? Get started for free with Sona.

Effective Google Ads for Insurance Services start with a focused keyword strategy. Developing segmented keyword lists ensures that each insurance product—whether auto, health, life, or commercial—targets distinct, high-intent search terms. Long-tail phrases such as “business property insurance for startups” or “affordable life insurance for parents” consistently deliver more qualified leads and lower cost-per-click compared to broader, generic keywords. Applying negative keyword filters is essential to exclude irrelevant searches, which reduces wasted spend and improves campaign efficiency. Marketers who leverage intent data can identify trending search behavior and adjust their lists proactively, ensuring budget is allocated to keywords generating the highest likelihood of conversion.

Dynamic audience and keyword management is critical for insurance lead generation. When marketers integrate real-time behavioral insights, they can automatically update keyword lists and audience segments as prospects move from research to purchase intent. For a practical look at how insurance agents use Google Ads to generate leads and why it’s so effective for customer acquisition, see this overview of insurance leads with Google Ads. By surfacing in-market accounts and known visitors, teams can prioritize spend on the most promising segments, creating a sustainable pipeline of qualified insurance leads.

Insurance advertising strategies demand ad copy that speaks directly to the prospect’s pain points. Highlighting key benefits—such as “fast claims processing,” “tailored coverage,” or “24/7 support”—establishes immediate relevance. Trust signals like industry awards, customer ratings, and compliance certifications build credibility, especially in highly regulated fields like health or business insurance. Each ad variation should align with the needs of its target audience segment, ensuring that messaging for commercial clients differs from that directed at individual buyers.

Using real-time engagement data, marketers can iterate copy quickly to address emerging objections or capitalize on trending topics. This adaptive approach ensures ads remain timely and effective. For actionable guidance on crafting insurance ad headlines, copy, and visuals, review this guide to insurance ad copywriting. Teams that connect ad performance with CRM insights can personalize messaging by funnel stage, driving stronger response rates and accelerating the path from click to conversion.

Landing pages for insurance services must deliver a seamless experience from ad to action. Every element—headline, copy, visuals, and call-to-action—should mirror the promises made in the ad, reducing friction and boosting trust. For example, a campaign focused on “employer group health plans” should drive to a page featuring group coverage options, success stories, and a prominent quote request form. Responsive design and fast load times are essential, given mobile’s dominance in digital marketing for insurance.

Integrating visitor identification technology enables marketers to personalize landing content dynamically, such as pre-filling forms for returning prospects or tailoring testimonials by industry. Additionally, syncing enriched lead data with sales systems ensures that every high-value visitor is routed for timely follow-up, closing the loop between marketing and sales.

Ongoing optimization is at the heart of high-performing Google Ads targeting for insurance. By tracking conversions, call outcomes, and CRM activity, marketers can pinpoint which campaigns, keywords, and channels drive real business growth. Automated attribution connects online ad clicks to offline sales or policy signings, revealing the true ROI of each effort. For a comprehensive PPC strategy guide tailored to insurance companies, see this insurance company PPC playbook. Adjusting bids, budgets, and creative based on these insights ensures continuous improvement and efficient spend allocation.

Real-time audience syncing enables campaigns to react as prospects progress through the funnel, pausing ads for converted leads and prioritizing re-engagement for stalled opportunities. Advanced analytics also highlight micro-conversion signals, such as form starts or quote downloads, allowing insurance agencies to optimize not just for volume, but for lead quality and sales velocity. This closed-loop, data-first operating model supports both agile campaign management and scalable insurance agency online advertising. To see how you can put these optimizations into practice, get started for free with Sona.

Insurance providers can strategically increase online visibility and market share by deploying a multi-faceted digital approach. Modern revenue teams see measurable growth by connecting cross-channel marketing to data-enriched lead flows, tailoring every interaction to real-time prospect intent.

Cross-promoting educational resources within retargeting campaigns supports both brand authority and conversion rates. When high-value visitors engage with your content or request a quote but do not convert, serve them targeted resources—such as downloadable guides on risk management or explainer videos about policy benefits—across Google Display Network and YouTube. This approach keeps your agency top-of-mind, helps prospects move through the funnel, and positions your firm as a trusted advisor. When combined with technology that identifies which companies and buyers are visiting your website, marketers can prioritize high-value retargeting audiences and shift spend toward accounts showing in-market signals. For a practical guide on running Google Ads campaigns to generate insurance leads, see this step-by-step tutorial for insurance agents.

Upselling related products using CRM-driven segmentation refines the targeting for Google Ads for Insurance Services. By analyzing customer profiles and policy histories, insurance teams can present bundled offers—such as auto plus renters insurance or life plus disability coverage—to segments most likely to convert. Syncing enriched CRM data with ad platforms allows for dynamic audience updates, ensuring relevant upsell and cross-sell ads reach prospects as they become eligible. When a customer purchases a new policy, their audience segment can be updated automatically, moving them from acquisition to loyalty or cross-sell campaigns without manual intervention.

Partnering with industry associations for referral programs expands your network and increases trust. Localizing campaigns to specific cities, neighborhoods, or even ZIP codes further boosts digital marketing for insurance by targeting areas with the highest demand or competitive gaps. Localized ad copy and landing pages featuring agent names, testimonials from nearby clients, and region-specific coverage details increase relevance and drive higher engagement rates. For more actionable tips, explore our insurance marketing playbooks.

Exploring new campaign types and placements, guided by search query data, uncovers untapped opportunities in insurance agency online advertising. For example, Performance Max campaigns leverage automated placements across Search, Display, YouTube, and Gmail to maximize reach and discover which surfaces drive the best results. Detailed search term analysis reveals emerging customer needs and seasonal trends, allowing marketers to quickly adapt messaging and allocate budget to the highest-impact keywords.

Capturing offline conversion events—such as policy signings or call-in quote completions—and integrating them back into your Google Ads campaigns gives a true picture of marketing ROI. Advanced attribution tools connect online ad engagement to offline sales activities, closing the loop and enabling revenue teams to optimize spend based on actual policy revenue, not just form fills. Syncing these conversion events automatically ensures that your insurance lead generation efforts align with both marketing and sales goals, helping B2B teams focus on the channels and tactics that deliver bottom-line impact. Ready to optimize your insurance marketing and sales alignment? Get started for free with Sona.

Leveraging Google Ads effectively for your insurance services can significantly enhance your visibility and drive valuable leads. By understanding the intricacies of targeting, budgeting, and ad creation, you can transform your online presence and reach potential clients more efficiently.

Throughout this article, we've explored the key challenges you may face when using Google Ads, such as selecting the right keywords, setting optimal budgets, and crafting compelling ad copy. By applying the strategies discussed, you can overcome these hurdles and optimize your campaigns for better performance and ROI.

Imagine a future where your insurance services are front and center, attracting the ideal clientele and building a robust pipeline of leads. By taking action today, you're not just investing in advertising; you're investing in growth, innovation, and your company's future success.

To fully realize this potential, start for free and experience our platform's capabilities today.

Insurance agents can effectively use Google Ads by targeting high-intent prospects, using precise audience targeting, and integrating data-driven strategies that align with buyer journeys to optimize campaigns in real-time.

The budget for Google Ads in the insurance industry should focus on high-intent keywords and audience segments that generate the strongest signals, enhancing lead quality and cost efficiency rather than spending on cold traffic.

Best practices include building targeted keyword lists, constructing high-intent audiences, designing conversion-driven landing pages, and leveraging remarketing to re-engage prospects based on their journey stage.

Success is measured by tracking conversions from click to policy sales, using advanced conversion tracking to link online interactions with offline sales, and optimizing campaigns based on ROI insights.

Common mistakes include targeting broad, generic keywords that do not convert well, failing to align landing pages with ad messaging, and not continuously optimizing campaigns with real-time data feedback.

Join results-focused teams combining Sona Platform automation with advanced Google Ads strategies to scale lead generation

Connect your existing CRM

Free Account Enrichment

No setup fees

No commitment required

Free consultation

Get a custom Google Ads roadmap for your business

Join results-focused teams combining Sona Platform automation with advanced Meta Ads strategies to scale lead generation

Connect your existing CRM

Free Account Enrichment

No setup fees

No commitment required

Free consultation

Get a custom Google Ads roadmap for your business

Join results-focused teams combining Sona Platform automation with advanced LinkedIn Ads strategies to scale lead generation

Connect your existing CRM

Free Account Enrichment

No setup fees

No commitment required

Free consultation

Get a custom Google Ads roadmap for your business

Join results-focused teams using Sona Platform automation to activate unified sales and marketing data, maximize ROI on marketing investments, and drive measurable growth

Connect your existing CRM

Free Account Enrichment

No setup fees

No commitment required

Free consultation

Get a custom Google Ads roadmap for your business

Over 500+ auto detailing businesses trust our platform to grow their revenue

Join results-focused teams using Sona Platform automation to activate unified sales and marketing data, maximize ROI on marketing investments, and drive measurable growth

Connect your existing CRM

Free Account Enrichment

No setup fees

No commitment required

Free consultation

Get a custom Google Ads roadmap for your business

Over 500+ auto detailing businesses trust our platform to grow their revenue

Join results-focused teams using Sona Platform automation to activate unified sales and marketing data, maximize ROI on marketing investments, and drive measurable growth

Connect your existing CRM

Free Account Enrichment

No setup fees

No commitment required

Free consultation

Get a custom Google Ads roadmap for your business

Over 500+ auto detailing businesses trust our platform to grow their revenue

Our team of experts can implement your Google Ads campaigns, then show you how Sona helps you manage exceptional campaign performance and sales.

Schedule your FREE 15-minute strategy sessionOur team of experts can implement your Meta Ads campaigns, then show you how Sona helps you manage exceptional campaign performance and sales.

Schedule your FREE 15-minute strategy sessionOur team of experts can implement your LinkedIn Ads campaigns, then show you how Sona helps you manage exceptional campaign performance and sales.

Schedule your FREE 15-minute strategy sessionOur team of experts can help improve your demand generation strategy, and can show you how advanced attribution and data activation can help you realize more opportunities and improve sales performance.

Schedule your FREE 30-minute strategy sessionOur team of experts can help improve your demand generation strategy, and can show you how advanced attribution and data activation can help you realize more opportunities and improve sales performance.

Schedule your FREE 30-minute strategy sessionOur team of experts can help improve your demand generation strategy, and can show you how advanced attribution and data activation can help you realize more opportunities and improve sales performance.

Schedule your FREE 30-minute strategy sessionOur team of experts can help improve your demand generation strategy, and can show you how advanced attribution and data activation can help you realize more opportunities and improve sales performance.

Schedule your FREE 30-minute strategy session

Launch campaigns that generate qualified leads in 30 days or less.